參考資料

FinRL_PortfolioAllocation_NeurIPS_2020.ipynb

FinRL_PortfolioAllocation_NeurIPS_2020.py

為了更準確地比較 MVO 策略和 DRL 模型的表現,教學原文這邊修改了 MVO 的計算方法,使其與 DRL 模型的動態特性相匹配。

max_sharpe()改為min_volatility(),以最小化波動率。前篇文章中的 MVO 策略是一次性計算並持有至到期,但因為與 portfolio allocation 需動態調整資產配置的目的不符,因此修改。

前篇文章中的 MVO 策略單一資產的最大占比為 0.5,可能導致過度集中投資,總之就是可能的獲利較大但風險也較大。

以下是修改後的 MVO 計算函數:

def calculate_daily_rebalanced_mvo_portfolio(df, unique_trade_dates, initial_capital=1000000):

"""

通過每日再平衡計算最小方差組合(MVO)。

參數:

- df:包含股票數據的 DataFrame,需要包含 'date'、'tic'、'close' 和 'return_list' 列。

- unique_trade_dates:交易日期的列表或數組。

- initial_capital:初始資金,默認為 1,000,000。

返回:

- portfolio:包含賬戶價值隨時間變化的 DataFrame。

"""

from pypfopt.efficient_frontier import EfficientFrontier

import numpy as np

# 初始化投資組合 DataFrame

portfolio = pd.DataFrame(index=range(1), columns=unique_trade_dates)

portfolio.loc[0, unique_trade_dates[0]] = initial_capital

# 遍歷交易日期,計算每日投資組合價值

for i in range(len(unique_trade_dates) - 1):

current_date = unique_trade_dates[i]

next_date = unique_trade_dates[i + 1]

# 獲取當前日期和下一日期的數據

df_current = df[df.date == current_date].reset_index(drop=True)

df_next = df[df.date == next_date].reset_index(drop=True)

# 計算當前日期的協方差矩陣

Sigma = df_current['return_list'][0].cov()

# 使用最小化波動率的方法計算權重

ef = EfficientFrontier(None, Sigma, weight_bounds=(0, 0.1))

ef.min_volatility()

cleaned_weights = ef.clean_weights()

# 計算每個資產的資金分配和持有數量

cap = portfolio.iloc[0, i]

weights = np.array(list(cleaned_weights.values()))

current_cash_allocation = weights * cap

current_prices = df_current['close'].values

current_shares = current_cash_allocation / current_prices

# 計算下一日期的投資組合價值

next_prices = df_next['close'].values

portfolio_value_next = np.dot(current_shares, next_prices)

# 存儲投資組合價值

portfolio.iloc[0, i + 1] = portfolio_value_next

# 轉置 DataFrame 並命名列

portfolio = portfolio.T

portfolio.columns = ['account_value']

return portfolio

通過上述修改,MVO 策略每天重新計算最優權重並再平衡,與 DRL 模型的動態調整相對應。

在對 DRL 模型進行回測之前,我們需要計算基準策略的績效,以便進行比較。這裡我們使用道瓊斯工業平均指數(DJI)和最小方差組合(MVO)作為基準。

### 獲取基準數據

dji_daily_return = calculate_dji_daily_return(TRADE_START_DATE, END_DATE)

unique_trade_date = trade['date'].unique()

mvo_portfolio = calculate_daily_rebalanced_mvo_portfolio(df, unique_trade_date)

mvo_daily_return = calculate_daily_return_from_portfolio(mvo_portfolio)

# 初始化交易環境

e_trade_gym = StockPortfolioEnv(df=trade, **env_kwargs)

# 進行回測

backtest_results = backtest_drl(e_trade_gym, trained_models)

# 繪製累計收益曲線

trade['date'] = pd.to_datetime(trade['date'])

time_ind = pd.Series(trade['date'].unique()).sort_values()

plot_cumulative_returns(backtest_results, time_ind, min_var_daily_return=mvo_daily_return, dji_daily_return=dji_daily_return)

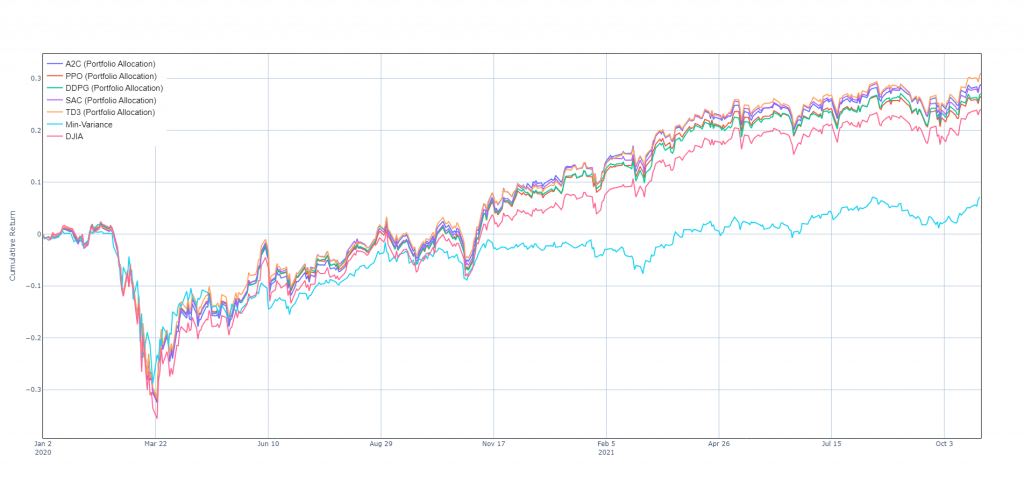

在動態修改資產配置的情況下,DRL 與 MVO 策略和 DJI 的累計收益曲線比較如下:

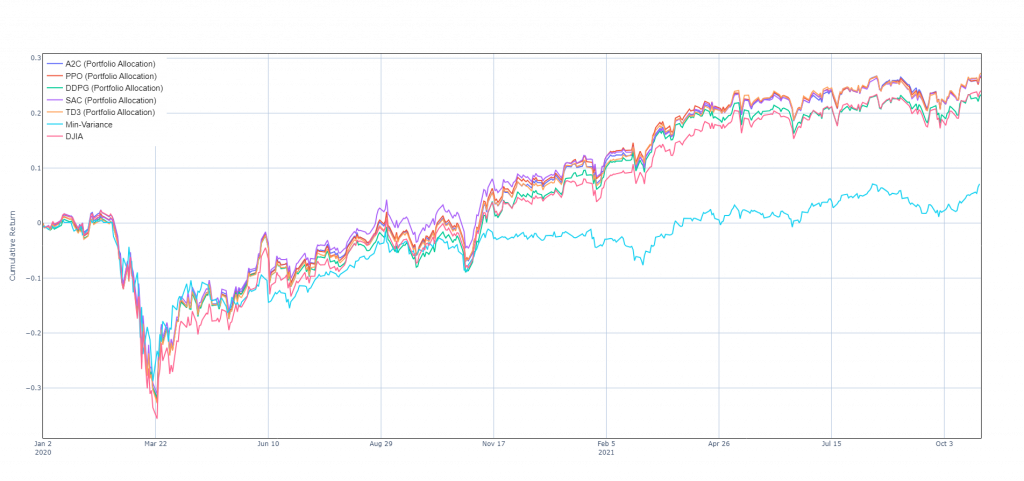

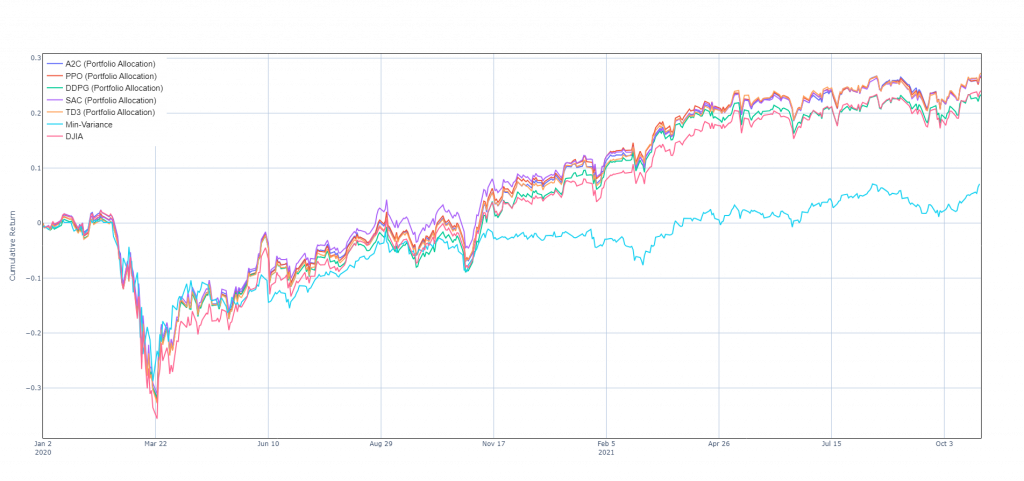

因為教學原文刻意讓訓練數據區間與回測數據區間重疊,所以這邊特別實驗了一下完全不重疊的情況,評估一下模型的泛化能力如何。

我將訓練數據區間改為 '2009-01-01' 至 '2019-12-31',交易(回測)數據區間為 '2020-01-01' 至 '2021-10-31'。

重新訓練模型並進行回測後,發現模型的績效有所下降,但其實也沒有下降非常多。

看起來 DRL 的模型還是有一定的泛化能力,但是在實際應用中,我最擔心的還是模型的泛化能力,畢竟資產數據量怎麼樣都不可能像圍棋那樣要多少有多少。

from stable_baselines3 import A2C, DDPG, PPO, SAC, TD3

from finrl.agents.stablebaselines3.models import DRLAgent

import plotly.graph_objs as go

import pandas as pd

import os

import quantstats as qs

def train_drl(e_trade_gym, models_info):

"""

Function to train deep reinforcement learning (DRL) models.

Parameters:

- e_trade_gym: The trading environment for backtesting.

- models_info: A dictionary containing the model class as keys and corresponding training parameters and paths as values.

Returns:

- trained_models: A dictionary containing the trained models.

"""

env_train, _ = e_trade_gym.get_sb_env()

# Initialize DRLAgent

agent = DRLAgent(env=env_train)

# Dictionary to store the trained models

trained_models = {}

# Loop through each model class and its associated information

for model_class, info in models_info.items():

model_path = info["save_path"]

if os.path.exists(model_path):

print(f"正在從 {model_path} 加載現有的 {model_class.__name__} 模型")

# Load the model using stable-baselines3

try:

model = model_class.load(model_path, env=env_train)

trained_models[model_class.__name__] = model

print(f"{model_class.__name__} 模型加載成功。")

except Exception as e:

print(f"加載 {model_class.__name__} 模型失敗: {e}")

print(f"將繼續訓練 {model_class.__name__} 模型。")

# Train the model if loading fails

model = agent.get_model(

model_name=model_class.__name__.lower(),

model_kwargs=info["params"])

trained_model = agent.train_model(

model=model,

tb_log_name=model_class.__name__.lower(),

total_timesteps=info["total_timesteps"])

trained_model.save(model_path)

trained_models[model_class.__name__] = trained_model

print(f"{model_class.__name__} 模型已訓練並保存到 {model_path}")

else:

print(f"正在訓練 {model_class.__name__} 模型...")

model = agent.get_model(model_name=model_class.__name__.lower(),

model_kwargs=info["params"])

trained_model = agent.train_model(

model=model,

tb_log_name=model_class.__name__.lower(),

total_timesteps=info["total_timesteps"])

trained_model.save(model_path)

trained_models[model_class.__name__] = trained_model

print(f"{model_class.__name__} 模型已訓練並保存到 {model_path}")

return trained_models

def backtest_drl(e_trade_gym, trained_models):

"""

Function to backtest all trained DRL models.

Parameters:

- e_trade_gym: The trading environment for backtesting.

- trained_models: Dictionary of trained models.

Returns:

- backtest_results: Dictionary containing daily returns and actions for each model.

"""

# 初始化 backtest 結果的字典

backtest_results = {}

# 對每個模型進行回測

for model_name, model in trained_models.items():

print(f"正在對 {model_name} 模型進行回測...")

# 使用該模型進行預測

df_daily_return, df_actions = DRLAgent.DRL_prediction(

model=model, environment=e_trade_gym)

# 儲存回測結果

backtest_results[model_name] = {

'daily_return': df_daily_return,

'actions': df_actions

}

# 輸出回測的前幾行結果作為確認

print(f"{model_name} 模型的每日回報:")

print(df_daily_return.head())

print(f"{model_name} 模型的動作:")

print(df_actions.head())

return backtest_results

def plot_html(trace_list, time_ind):

fig = go.Figure()

for trace in trace_list:

fig.add_trace(trace)

fig.update_layout(legend=dict(x=0,

y=1,

traceorder="normal",

font=dict(family="sans-serif",

size=15,

color="black"),

bgcolor="White",

bordercolor="white",

borderwidth=2), )

#fig.update_layout(legend_orientation="h")

fig.update_layout(

title={

#'text': "Cumulative Return using FinRL",

'y': 0.85,

'x': 0.5,

'xanchor': 'center',

'yanchor': 'top'

})

#with Transaction cost

#fig.update_layout(title = 'Quarterly Trade Date')

fig.update_layout(

# margin=dict(l=20, r=20, t=20, b=20),

paper_bgcolor='rgba(1,1,0,0)',

plot_bgcolor='rgba(1, 1, 0, 0)',

#xaxis_title="Date",

yaxis_title="Cumulative Return",

xaxis={

'type': 'date',

'tick0': time_ind[0],

'tickmode': 'linear',

'dtick': 86400000.0 * 80

})

fig.update_xaxes(showline=True,

linecolor='black',

showgrid=True,

gridwidth=1,

gridcolor='LightSteelBlue',

mirror=True)

fig.update_yaxes(showline=True,

linecolor='black',

showgrid=True,

gridwidth=1,

gridcolor='LightSteelBlue',

mirror=True)

fig.update_yaxes(zeroline=True,

zerolinewidth=1,

zerolinecolor='LightSteelBlue')

fig.show()

def plot_cumulative_returns(backtest_results,

time_ind,

min_var_daily_return=None,

dji_daily_return=None):

"""

Function to plot cumulative returns for DRL models, Min-Variance, and DJI.

Parameters:

- backtest_results: Dictionary containing daily returns for different DRL models.

- time_ind: Pandas Series of dates (x-axis values).

- min_var_daily_return: (Optional) Daily returns for the Min-Variance model. Default is None.

- dji_daily_return: (Optional) Daily returns for the DJI index. Default is None.

"""

# Initialize the figure

trace_list = []

# Loop through backtest results and add traces for each model's cumulative returns

for model_name, result in backtest_results.items():

df_daily_return = result['daily_return']

# 計算累積回報 (Cumulative Returns)

cumpod = (df_daily_return['daily_return'] + 1).cumprod() - 1

# Add trace for each model's cumulative return

trace = go.Scatter(x=time_ind,

y=cumpod,

mode='lines',

name=f'{model_name} (Portfolio Allocation)')

trace_list.append(trace)

# Conditionally add Min-Variance cumulative return trace if provided

if min_var_daily_return is not None:

# 計算MVO累積回報

min_var_cumpod = (min_var_daily_return + 1).cumprod() - 1

trace_min_var = go.Scatter(x=time_ind,

y=min_var_cumpod,

mode='lines',

name='Min-Variance')

trace_list.append(trace_min_var)

# Conditionally add DJI cumulative return trace if provided

if dji_daily_return is not None:

# 計算DJI累積回報

dji_cumpod = (dji_daily_return + 1).cumprod() - 1

trace_dji = go.Scatter(x=time_ind,

y=dji_cumpod,

mode='lines',

name='DJIA')

trace_list.append(trace_dji)

plot_html(trace_list, time_ind)

def generate_quantstats_report(daily_return_df, output_filename, title):

"""

Function to generate a QuantStats HTML report.

Parameters:

- daily_return_df: Pandas DataFrame containing 'date' and 'daily_return' columns.

- output_filename: The name of the output HTML file for the report.

- title: The title for the report.

Returns:

- None. The report will be saved as an HTML file.

"""

# 確保 'date' 列是 datetime 格式,並將其設置為索引

daily_return_df['date'] = pd.to_datetime(daily_return_df['date'])

daily_return_df.set_index('date', inplace=True)

# 確保 'daily_return' 是 pandas Series

daily_return_series = daily_return_df['daily_return']

# 使用 quantstats 生成 HTML 報告,將其保存為文件

qs.reports.html(daily_return_series, output=output_filename, title=title)

qs.reports.plots(daily_return_series)

print(f"Quantstats HTML 報告已生成並保存為 '{output_filename}'。")

def calculate_dji_daily_return(start_date, end_date):

"""

Calculate daily returns for the DJI index.

Parameters:

- start_date: The start date for fetching DJI data.

- end_date: The end date for fetching DJI data.

Returns:

- baseline_returns: Pandas Series containing daily returns for the DJI index.

"""

from finrl.plot import get_baseline, get_daily_return

# Fetch baseline DJI data

baseline_df = get_baseline(ticker='^DJI', start=start_date, end=end_date)

# Calculate daily returns for DJI

baseline_returns = get_daily_return(baseline_df, value_col_name="close")

return baseline_returns

def calculate_daily_rebalanced_mvo_portfolio(df,

unique_trade_dates,

initial_capital=1000000):

"""

通过每日再平衡计算最小方差组合(MVO)。

参数:

- df:包含股票数据的 DataFrame,需要包含 'date'、'tic'、'close' 和 'return_list' 列。

- unique_trade_dates:交易日期的列表或数组。

- initial_capital:初始资金,默认为 1,000,000。

返回:

- portfolio:包含账户价值随时间变化的 DataFrame。

"""

from pypfopt.efficient_frontier import EfficientFrontier

import numpy as np

# 初始化投资组合 DataFrame

portfolio = pd.DataFrame(index=range(1), columns=unique_trade_dates)

portfolio.loc[0, unique_trade_dates[0]] = initial_capital

# 遍历交易日期,计算每日投资组合价值

for i in range(len(unique_trade_dates) - 1):

current_date = unique_trade_dates[i]

next_date = unique_trade_dates[i + 1]

# 获取当前日期和下一日期的数据

df_current = df[df.date == current_date].reset_index(drop=True)

df_next = df[df.date == next_date].reset_index(drop=True)

# 计算当前日期的协方差矩阵

Sigma = df_current['return_list'][0].cov()

# 使用最小化波动率的方法计算权重

ef = EfficientFrontier(None, Sigma, weight_bounds=(0, 0.1))

ef.min_volatility()

cleaned_weights = ef.clean_weights()

# 计算每个资产的资金分配和持有数量

cap = portfolio.iloc[0, i]

weights = np.array(list(cleaned_weights.values()))

current_cash_allocation = weights * cap

current_prices = df_current['close'].values

current_shares = current_cash_allocation / current_prices

# 计算下一日期的投资组合价值

next_prices = df_next['close'].values

portfolio_value_next = np.dot(current_shares, next_prices)

# 存储投资组合价值

portfolio.iloc[0, i + 1] = portfolio_value_next

# 转置 DataFrame 并命名列

portfolio = portfolio.T

portfolio.columns = ['account_value']

return portfolio

def calculate_daily_return_from_portfolio(portfolio):

"""

Calculate daily returns from a portfolio's account value.

Parameters:

- portfolio: DataFrame containing the portfolio's account value over time.

Returns:

- daily_return: Pandas Series containing daily returns.

"""

# 確保 'account_value' 列存在於 portfolio 中

if 'account_value' not in portfolio.columns:

raise ValueError("Portfolio must contain 'account_value' column")

# 計算每日回報

daily_return = portfolio['account_value'].pct_change().dropna()

return daily_return

def calculate_cov_list(df, lookback=252):

"""

Calculate cov_list and return_list from price data.

Parameters:

- df: The dataframe containing the price data.

- lookback: The lookback period for calculating the covariance (default is 252, which represents a year).

Returns:

- df: DataFrame with the calculated cov_list and return_list.

"""

df = df.sort_values(['date', 'tic'], ignore_index=True)

df.index = df.date.factorize()[0]

cov_list = []

return_list = []

for i in range(lookback, len(df.index.unique())):

data_lookback = df.loc[i - lookback:i, :]

price_lookback = data_lookback.pivot_table(index='date',

columns='tic',

values='close')

return_lookback = price_lookback.pct_change().dropna()

return_list.append(return_lookback)

# 計算協方差矩陣

covs = return_lookback.cov().values

cov_list.append(covs)

# 將協方差矩陣加入 df

df_cov = pd.DataFrame({

'date': df.date.unique()[lookback:],

'cov_list': cov_list,

'return_list': return_list

})

df = df.merge(df_cov, on='date')

df = df.sort_values(['date', 'tic']).reset_index(drop=True)

return df

def main():

from finrl import config

from finrl import config_tickers

from finrl.meta.data_processors.processor_yahoofinance import YahooFinanceProcessor

from finrl.meta.env_portfolio_allocation.env_portfolio import StockPortfolioEnv

from finrl.meta.preprocessor.preprocessors import FeatureEngineer, data_split

# 設定環境

TIME_INTERVAL = '1D'

START_DATE = '2008-01-01'

END_DATE = '2021-10-31'

RAW_DATA_PATH = f'./datasets/DOW30_{TIME_INTERVAL}_{START_DATE}_to_{END_DATE}.csv'

TRAIN_START_DATE = '2009-01-01'

TRAIN_END_DATE = '2019-12-31'

TRADE_START_DATE = '2020-01-01'

## Part 3. Download Data

print(config_tickers.DOW_30_TICKER)

if not os.path.exists(RAW_DATA_PATH):

dp = YahooFinanceProcessor()

df = dp.download_data(start_date=START_DATE,

end_date=END_DATE,

ticker_list=config_tickers.DOW_30_TICKER,

time_interval=TIME_INTERVAL)

df.to_csv(RAW_DATA_PATH)

else:

df = pd.read_csv(RAW_DATA_PATH)

if 'date' not in df.columns and 'timestamp' in df.columns:

df = df.rename(columns={'timestamp': 'date'})

### 特徵工程

"""

後面初始化StockPortfolioEnv時 "tech_indicator_list": config.INDICATORS

會需要指定使用的技術指標,

所以這裡先對數據進行特徵工程, 取得技術指標

"""

fe = FeatureEngineer(use_technical_indicator=True,

use_turbulence=False,

user_defined_feature=False)

df = fe.preprocess_data(df)

# 計算協方差矩陣

df = calculate_cov_list(df)

# 獲取訓練數據 (假設你已經準備好數據)

# 注意,你需要根據實際情況調用數據處理過程,例如 data_split 或其他

train, trade = data_split(df, TRAIN_START_DATE,

TRAIN_END_DATE), data_split(

df, TRADE_START_DATE, END_DATE)

# 定義環境參數

stock_dimension = len(train.tic.unique())

state_space = stock_dimension

print(f"Stock Dimension: {stock_dimension}, State Space: {state_space}")

env_kwargs = {

"hmax": 100,

"initial_amount": 1000000,

"transaction_cost_pct": 0.001,

"state_space": state_space,

"stock_dim": stock_dimension,

"tech_indicator_list": config.INDICATORS,

"action_space": stock_dimension,

"reward_scaling": 1e-4

}

# 初始化環境

e_train_gym = StockPortfolioEnv(df=train, **env_kwargs)

# 定義模型類別映射和參數

models_info = {

A2C: {

"params": {

"n_steps": 5,

"ent_coef": 0.005,

"learning_rate": 0.0002

},

"total_timesteps": 50000,

"save_path": './training/portfolio_allocation/trained_a2c.zip'

},

PPO: {

"params": {

"n_steps": 2048,

"ent_coef": 0.005,

"learning_rate": 0.0001,

"batch_size": 128,

},

"total_timesteps": 80000,

"save_path": './training/portfolio_allocation/trained_ppo.zip'

},

DDPG: {

"params": {

"batch_size": 128,

"buffer_size": 50000,

"learning_rate": 0.001

},

"total_timesteps": 50000,

"save_path": './training/portfolio_allocation/trained_ddpg.zip'

},

SAC: {

"params": {

"batch_size": 128,

"buffer_size": 100000,

"learning_rate": 0.0003,

"learning_starts": 100,

"ent_coef": "auto_0.1",

},

"total_timesteps": 50000,

"save_path": './training/portfolio_allocation/trained_sac.zip'

},

TD3: {

"params": {

"batch_size": 100,

"buffer_size": 1000000,

"learning_rate": 0.001

},

"total_timesteps": 30000,

"save_path": './training/portfolio_allocation/trained_td3.zip'

}

}

### get baseline

dji_daily_return = calculate_dji_daily_return(TRADE_START_DATE, END_DATE)

unique_trade_date = trade['date'].unique()

mvo_portfolio = calculate_daily_rebalanced_mvo_portfolio(

df, unique_trade_date)

mvo_daily_return = calculate_daily_return_from_portfolio(mvo_portfolio)

# 訓練模型

trained_models = train_drl(e_train_gym, models_info)

# 初始化交易環境

e_trade_gym = StockPortfolioEnv(df=trade, **env_kwargs)

# 進行回測

backtest_results = backtest_drl(e_trade_gym, trained_models)

# 假設 backtest_results 來自 backtest_drl 函數

trade['date'] = pd.to_datetime(trade['date'])

time_ind = pd.Series(trade['date'].unique()).sort_values()

plot_cumulative_returns(backtest_results,

time_ind,

min_var_daily_return=mvo_daily_return,

dji_daily_return=dji_daily_return)

print(backtest_results)

# 假設你想用 PPO 模型的回報生成 quantstats 報告

ppo_daily_return = backtest_results['PPO']['daily_return']

generate_quantstats_report(ppo_daily_return, "PPO_performance_report.html",

"PPO Performance Report")

if __name__ == "__main__":

main()